Our Approach

At Mendel Money Management, we focus on helping you create a strong investment portfolio to meet your goals and objectives.

To do this, we assist you in the following areas:

- Setting realistic targets aimed at long-term success

- Determining your appropriate level of risk

- Creating the CORE of your portfolio FIRST

- Deciding if and how much to invest outside of your CORE portfolio

CREATE

- Analyze current financial situation and compare with established goals

- Promote a plan and series of recommendations to achieve your financial and lifestyle goals

COLLABORATE

- Review our recommendations and rationale

- Share our plan with your other trusted advisors, such as accountants and lawyers

- Adjust plan based on feedback

DEPLOY

- Work closely to implement strategies

- Partner to ensure all recommendations have been implemented according to the plan

EVOLVE

- As your needs change, our process continually refines and adapts our planning efforts to meet your needs

- Ensure your plan stays current with new laws and market conditions

- Continue to work with you to implement any changes required to keep you on track towards your lifestyle goals

A Disciplined Approach To Investing

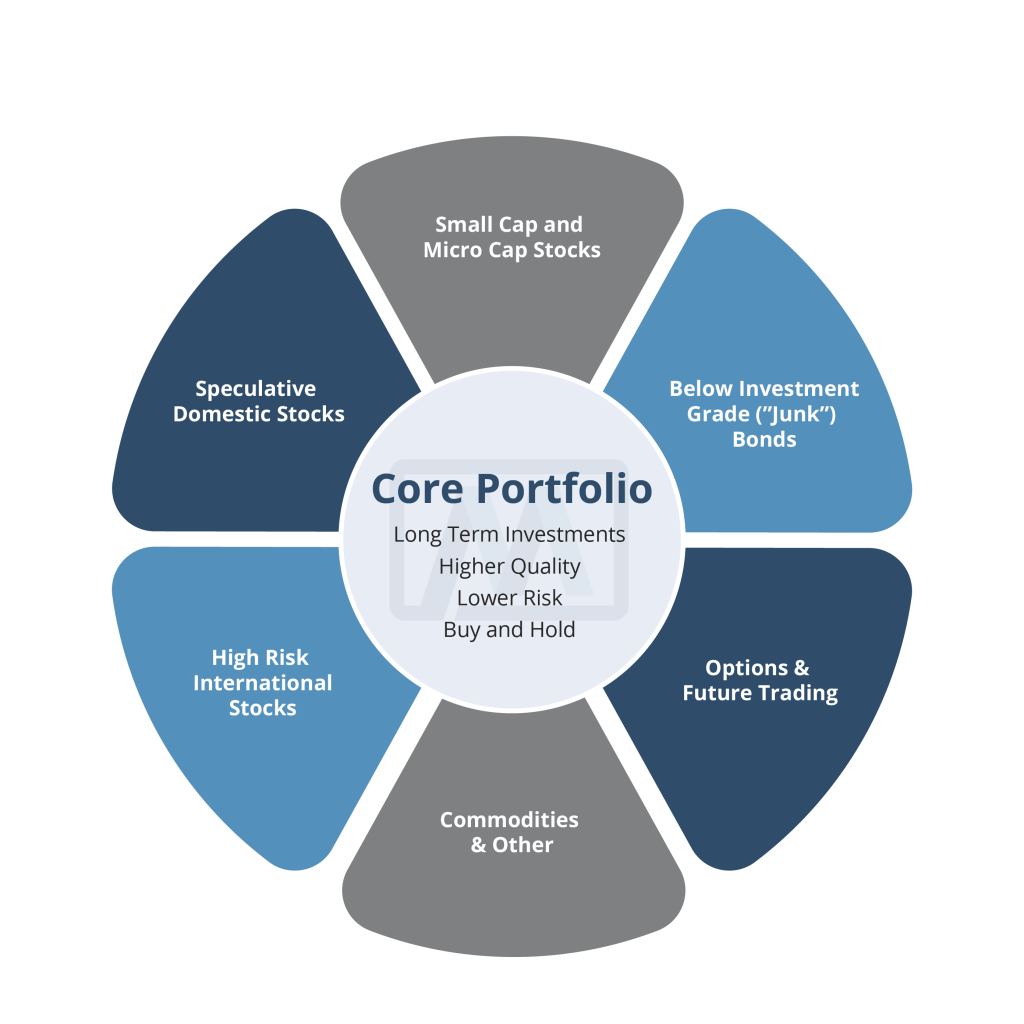

The core of your portfolio will consist of high-quality equities and fixed-income investments focused on companies with consistent profitability, robust finances, and solid growth prospects on at least a 3-to-5-year timeline. These companies provide the stability and growth needed to help you reach

your desired financial results.

These are stocks of small companies with a market cap below $2 billion. Although a minority of these companies are established enterprises with strong balance sheets, many others are younger growth-oriented companies that tend to have higher volatility and less liquidity. Most small capitalization stocks exhibit higher price volatility and have less market liquidity, causing them to be higher risk investments. In addition, many investors may be lured to speculate in low-priced or “penny” stocks in an effort to “make a killing. The lure of buying many shares of a stock at an extremely low price, such as ten cents a share in the hopes that the share price will rise to a dollar a share, is often enough to cause many investors to buy shares of companies with broken and failed business models in the hope that “a frog will turn into a prince”. The vast majority of these microcap and penny stocks provide little or no reward to the speculator.

Junk bonds, also referred to as high yield bonds, have a credit rating below BBB/Baa and are not investment grade, and as a result many institutional portfolios or funds cannot purchase or hold them. Junk bonds carry a higher risk of default, and provide higher percent yields to attract investors and hopefully offset their riskiness. Many junk bonds have equity-like risk profiles but may not compete effectively with equity counterparts.

Commodities are raw material inputs such as grains, beef, lumber, metals, precious metals, oil, and natural gas, used to manufacture finished products and goods. Commodity contracts are traded publicly to permit buyer and seller to establish and implement purchase and sale of the commodity. Additional examples of tradeable products included in the “other” category include agricultural products and other basic materials (i.e. rubber or palm oil) from around the globe.

International stocks are equity securities of foreign companies typically domiciled in foreign countries and traded oninternational exchanges outside of the US. Risks associated with these stocks include access to reliable information, foreign country and government/political risks, foreign economic risks, foreign controls and different reporting requirements compared to requirements imposed upon U.S. publicly traded companies. Larger U.S. publicly traded companies typically have significant international exposure in their various businesses and provide significant exposure to these markets without these additional risks. These U.S. based companies can typically manage foreign exposures much more effectively that outside investors can on their own.

Futures and options, also known as financial derivatives, are types of contracts between two parties to purchase and sell a stock, index, or commodity at a predetermined price and on or before a predetermined future date. These financial instruments may be used to speculate on future moves in stock prices, but also may also be employed as a risk management tool and/or a yield enhancement tool within a portfolio. Speculating with options and futures is extremely risky with a high likelihood of loss, while properly used may actually reduce risk and enhance return. Financial options and futures contracts on currencies and indeces, and speculation in these contracts can also be very risky.

Establishing the core of your portfolio first creates a disciplined approach that will yield rewards in the long run.

Our Insights

-

Retirement Contributions – Pre-Tax, Roth, or Both?March 7, 2024/0 Comments

Retirement Contributions – Pre-Tax, Roth, or Both?March 7, 2024/0 Comments -

-

What the SEC’s Bitcoin ETF Approval Means for InvestorsFebruary 8, 2024/

What the SEC’s Bitcoin ETF Approval Means for InvestorsFebruary 8, 2024/