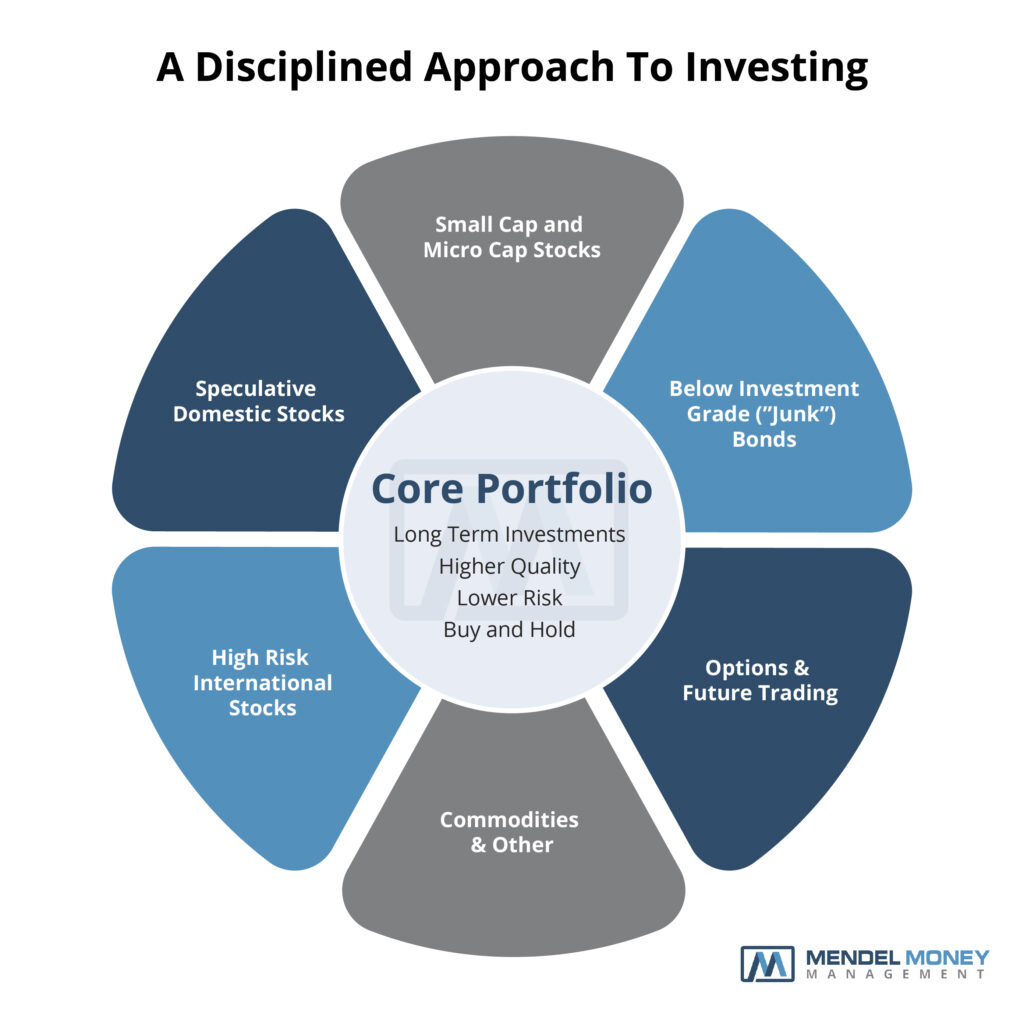

To achieve success when investing for the long term, it is essential to have a disciplined approach. At Mendel Money Management, we have guiding principles that help our portfolio design and construction for our clients. We believe that building the core of your portfolio is critical to meeting your primary financial goals and objectives before potentially allocating a portion of your assets to higher-risk, peripheral investment opportunities.

First, set your financial goals and objectives

When it comes to investing, discipline is critical. Without a clear purpose and plan, it can be easy to lose sight of your goals and make poorly-thought-out decisions that may jeopardize your financial security. That’s why it’s so important to establish investment goals and objectives early. By assessing your risk tolerance, time horizon, and desired returns, you can develop a personalized strategy to help you stay on track and reach your targets.

Goals and objectives are different for everyone. Here are a few examples of shared financial goals for investors across a wide variety of life situations:

- Fund children’s educational needs

- Buying a new car

- Buying a home

- Funding retirement

Second, define your risk tolerance

Risk tolerance refers to an individual’s ability to experience losses within one’s investment portfolio. Knowing one’s risk tolerance before investing is essential, as this will help determine what types and amounts of assets to purchase. For example, someone with a low-risk tolerance may only invest in securities that are unlikely to lose much value, even if they also have the potential to generate only modest returns. On the other hand, someone with a high-risk tolerance may be more willing to invest in more volatile assets such as equities, which can generate higher returns but also come with more significant risks.

Each component in a portfolio has a specific job. Lower risk investments help maintain the foundation and security of your assets, while riskier, more aggressive investments can help generate higher long-term capital gains. It is essential to strike a balance of controlling risk and achieving long-term returns to meet your financial goals and objectives. Therefore, at Mendel Money Management, we believe everyone should have a financial plan. A financial plan helps you understand how much risk you must take to be able meet your goals. Most people cannot afford to hold a portfolio of all cash or government bonds. We can help you construct a portfolio that you can maintain through challenging market environments, thus helping you achieve your long-term goals and objectives. The most significant risk to achieving one’s financial plans is trying to time the market and/or selling their investment portfolio because they have sustained losses greater than they can emotionally handle.

Third, determine an appropriate asset allocation

To align investment portfolio risk tolerance and expected return profile designed to meet your financial goals and objectives, we help to determine an appropriate asset allocation. Age and time horizon are critical factors in determining an appropriate asset allocation. Still, just as important are your short and intermediate-term financial needs as well as defining your risk tolerance.

We consider asset allocation as a mix of stocks, bonds, and cash. However, if you hold a more aggressive mix of stocks, you may need to hold more bonds and/or cash to meet your goals and objectives. You must understand your alternatives and take a disciplined approach to changing your asset allocation.

Fourth, establish the CORE of the equity portfolio FIRST

Many investors make the mistake of chasing near term performance when they should be focused on meeting their goals within the context of their risk tolerance. When investing, it’s essential to take a disciplined approach. That means establishing the core of your equity portfolio first. This will ensure that your needs are taken care of and that you’re not taking inappropriate risks. The core of your portfolio should consist of investments in high-quality, consistently profitable companies with strong financial positions and solid growth prospects with at least a 3-to-5-year time horizon. These companies will provide the stability and growth needed to reach your financial goals. By establishing the core of your portfolio first, you’ll be taking a disciplined approach to investing that will pay off in the long run.

Final Thoughts

A life-long commitment to investing in a core portfolio is essential for everyone. There may be a place for exposure to riskier areas of the market; however, without first establishing the core of your portfolio, you are likely taking unnecessary risks, and you may not be able to attain your financial goals and objectives. The key is to develop a disciplined investment strategy and to stick with the plan. This means setting clear goals, evaluating risk tolerance, and diversifying your portfolio. It also means being patient and staying the course, even when the markets are volatile.

After all, long-term success in investing is not about timing the market – it’s about time in the market. By taking a disciplined approach to investing, you can give yourself the best chance of achieving your financial goals.